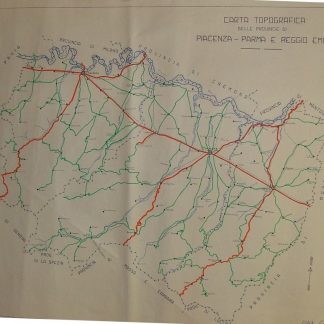

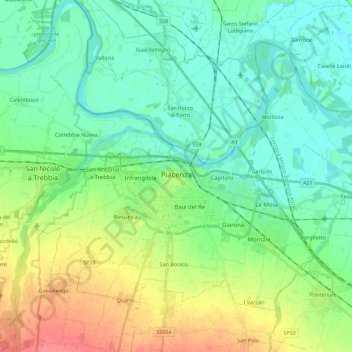

CARTA TERRITORIALE DELLA PROVINCIA DI PARMA, PIACENZA, REGGIO EMILIA E MODENA - Eliofototecnicabarbieri

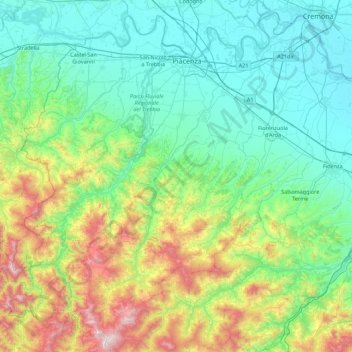

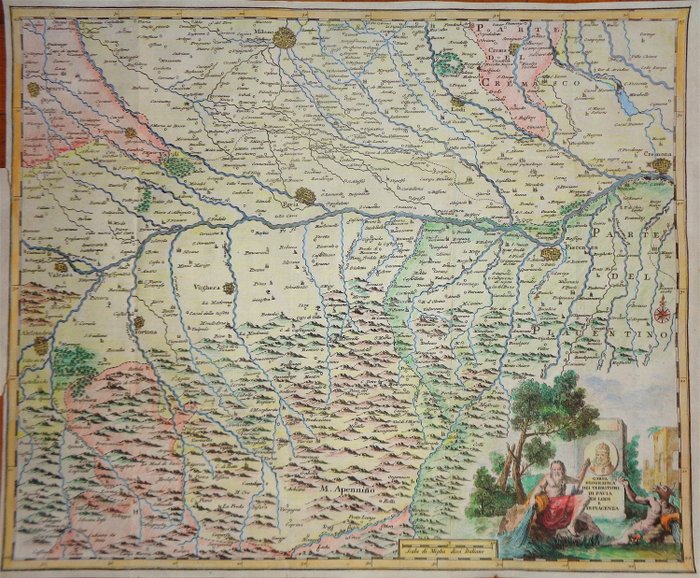

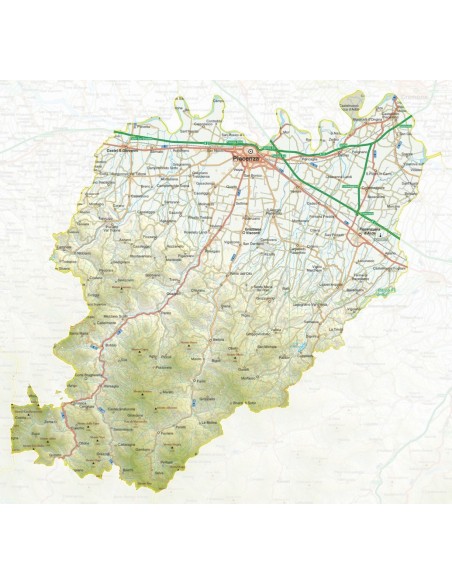

Carta Corografica dei Ducati di Parma, Piacenza e Guastalla. Zuccagni - Orlandini edit. & V.Stanghi e G.Maina inc - Libro Usato - ND - | IBS

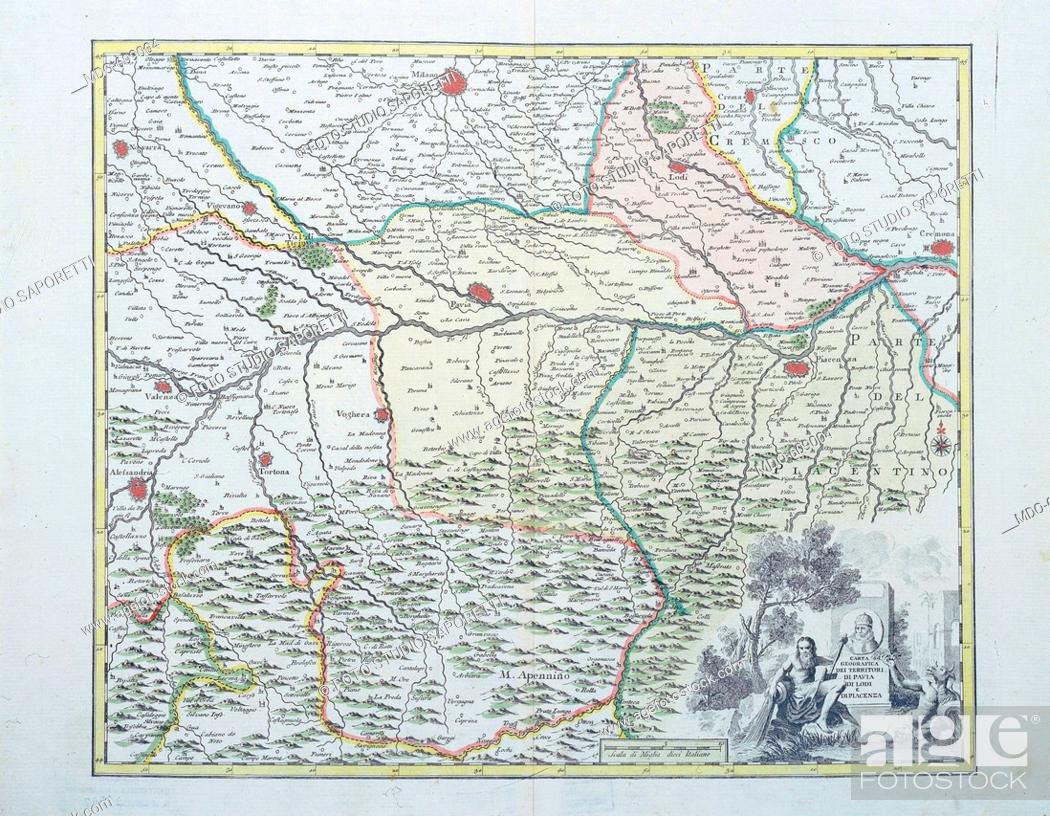

Carta Geografica dei Territori di Pavia di Lodi e Di Piacenza - Antique Print Map Room | Botanical illustration, History images, Illustration

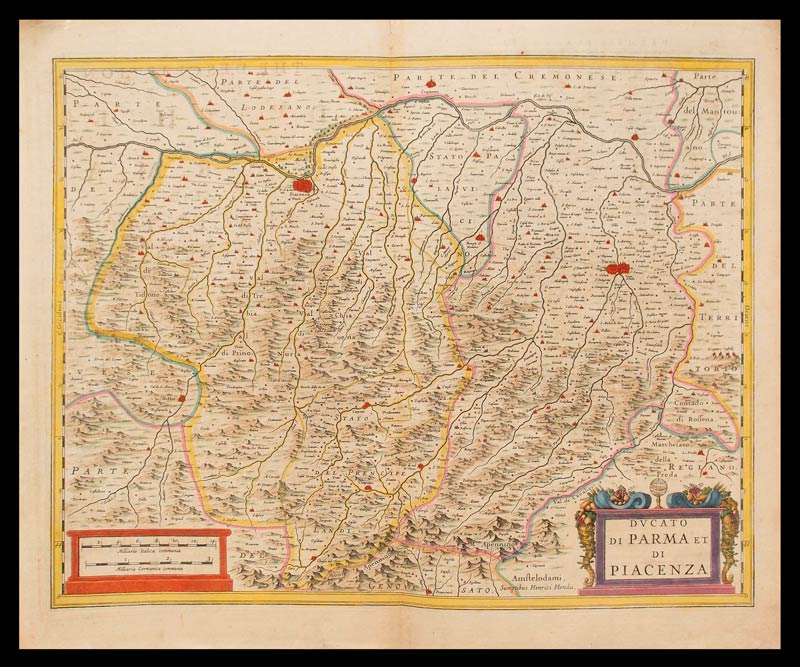

Pavia. Map of the territories of Pavia, Lodi and Piacenza (Pavia, Stock Photo, Picture And Rights Managed Image. Pic. MDO-609004 | agefotostock